Doximity (DOCS) Deep Dive

The 'LinkedIn for Doctors': A Scarce Asset With Deep Network Effects And A Long Runway For Growth

(May, 2024)

Executive Summary

Doximity is the ‘LinkedIn’ for Doctors and counts more than 80% of registered Physicians in the US as their members. They have hit critical mass in this market establishing powerful network effects.

What is the value of a network? That depends on what those who want access are willing to pay for it. Over 70% of healthcare spending in the US is decided by Doctors. Doximity stands as the gatekeeper between the key decision makers in healthcare and the $4T in annual US healthcare spend.

Doximity is in the early innings of their monetization journey with a long runway for growth and many levers at their disposal. I forecast the company to continue to grow sales at a LDD+ CAGR for the coming decade while maintaining FCF margins in the high 30s.

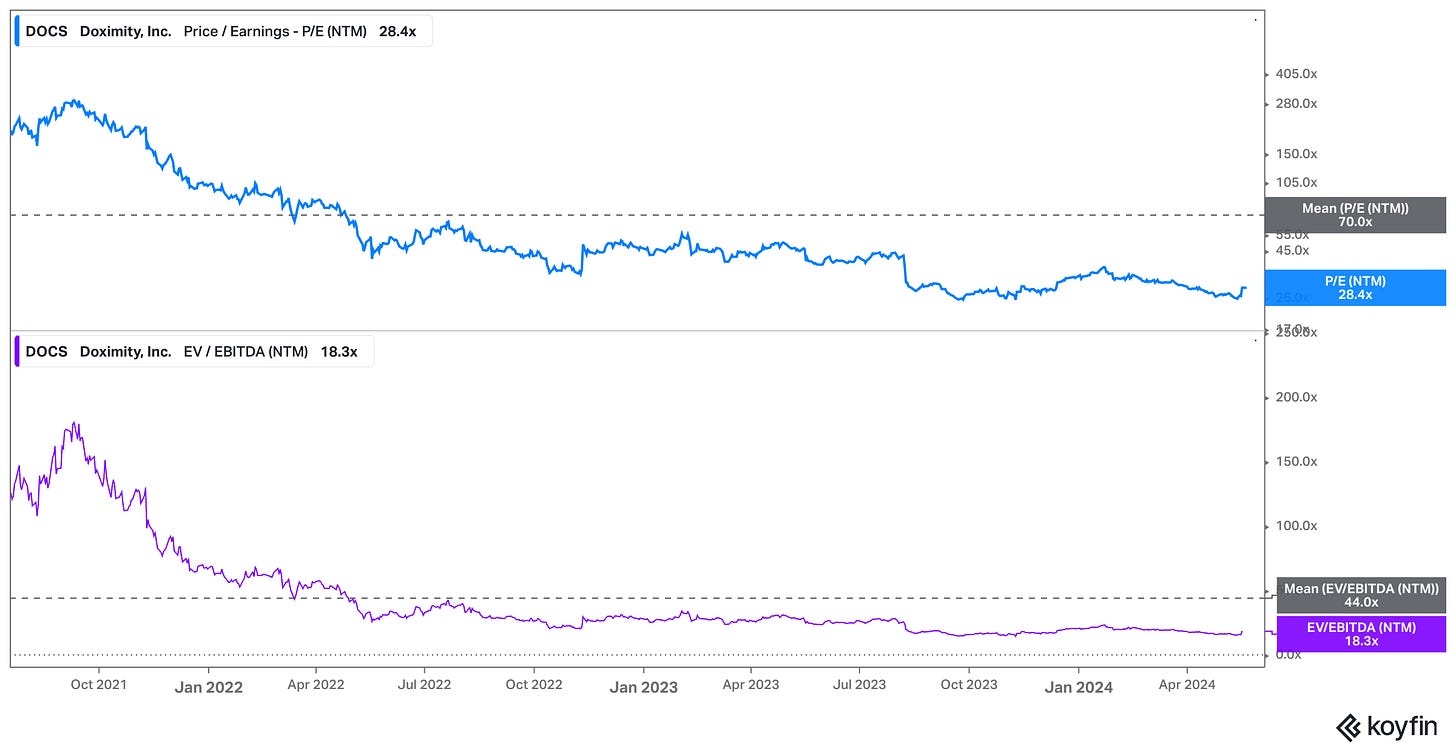

I first stumbled across DOCS shortly after they came public but at a lofty multiple of over 100x EBITDA, it was quickly sidelined.

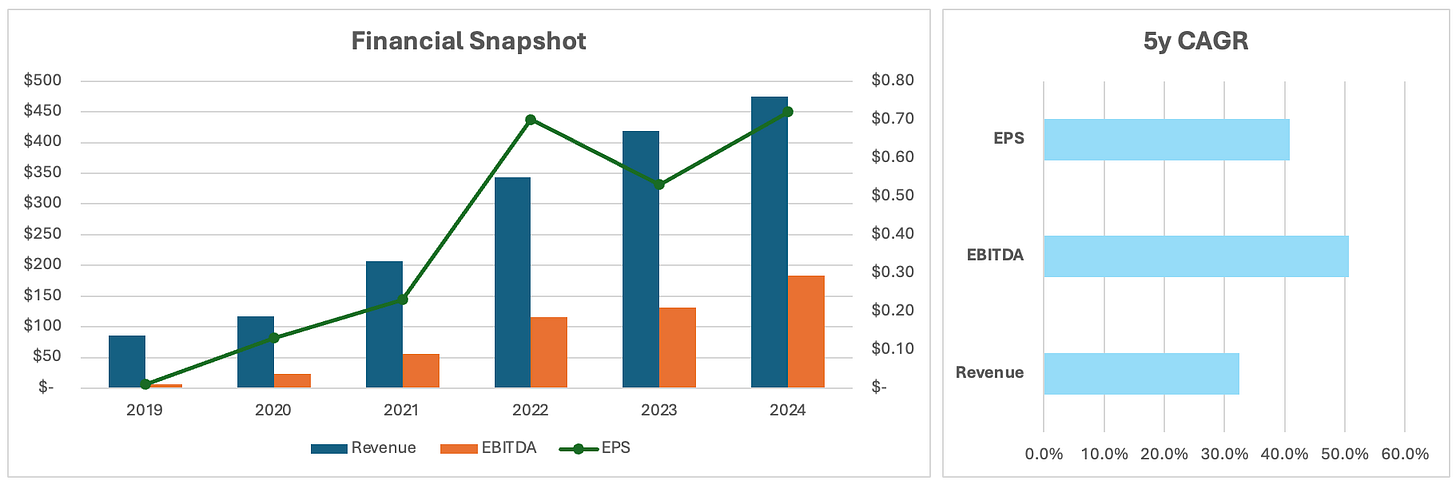

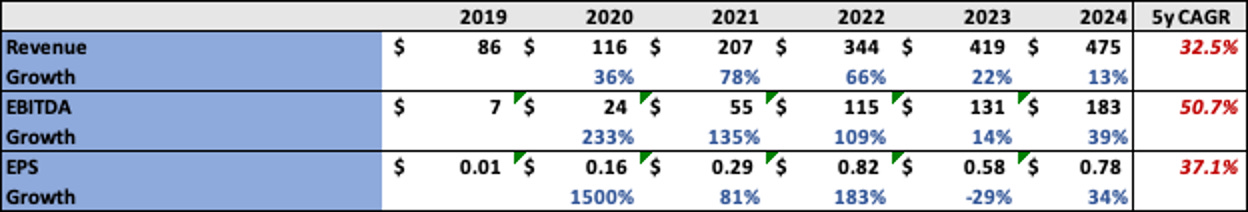

Nearly three years later the stock is down 72% from its peak and fundamentals have continued to march on at a healthy clip. Since the IPO, EBITDA has compounded at 50% CAGR, resulting in an attractive valuation proposition.

Company Overview

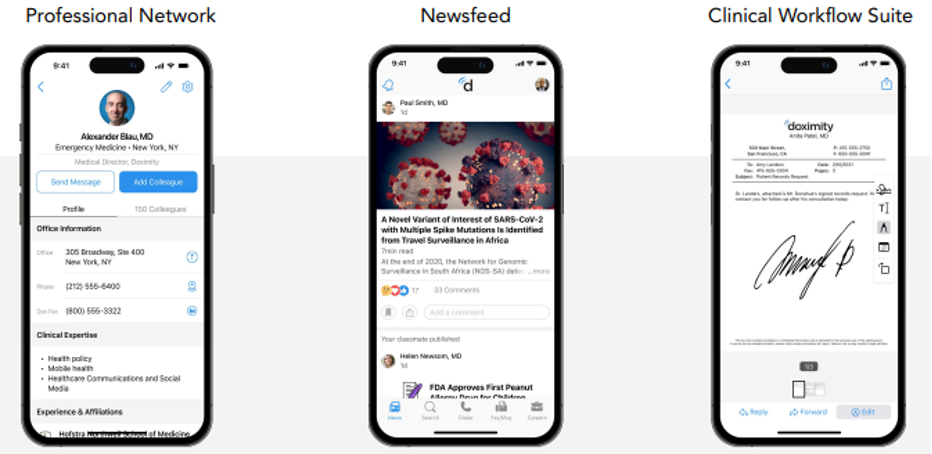

Doximity is often described as the ‘LinkedIn for Doctors’. With 2 million members they are the leading digital platform for US Medical Professionals hosting;

· 80% of registered Physicians

· 60% of Nurse Practitioners and Physicians Assistants

· 90% of Graduating Medical Students

I recommend you take some time to watch this video first: Doximity Platform Overview

Like LinkedIn, Doximity operates as a social media platform with its teeth in the enterprise software space.

Doximity for Doctors

The platform is free to join and use for medical professionals. The process is simple;

Download the app > Complete profile > Credential verification.

The platform serves many functions allowing users to write, comment, read, learn, and network. If you are on any social media this should all sound very standard;

Social

· Profile - The profile will be pre-populated with all publicly and commercially available third-party data which members can then add to. This includes education and training, hospital affiliations, practice contact information, certifications and licenses, specialization and clinical expertise, links to published research reports, and press mentions.

The added step of verification is a key differentiator of Doximity vs LinkedIn and allows physicians to use the platform to make referrals and seek medical advice from reputable sources within their network.

· Search - Members can use the platform to find other professionals by name, specialty, expertise, affiliations, or locations. Again, this adds to the referral process.

· Careers – Members can browse permanent and locum positions, set up job alerts, and directly connect with recruiters. Other features include a salary map.

Another key feature is Residency Navigator which was introduced in 2015 and ensures early customer acquisition. This allows students to compare and discover programs nationwide, powered by peer nominations and ratings. Importantly, DOCS is entirely impartial here and does not accept any payment for promotion of these so reviews stay honest.

· Newsfeed – This contains a mix of sponsored and non-sponsored articles, posts, conference notifications, and peer career updates.

Productivity

DOCS includes many of the following features for free (or at cost) to increase platform engagement and in turn, supply for their advertisers.

· Digital Workflow: Fax & eSignature – This allows physicians to send and receive HIPPA-compliant faxes through their mobile app/ website. They can create – send – sign – edit – date documents and add attachments enabling fully digitized record keeping.

The importance of this cannot be understated. Over 80% of HC documents in the US are sent via mail or traditional fax. The industry is ripe for digitization. A digital fax is not ground-breaking technology. This also frees up a significant amount of time which doctors must spend painstakingly on admin.

· Secure Messaging – Enabling coordination of patient consultations across multiple teams, specialists, and locations.

· Dialer – This is Doximity’s telehealth product which offers both secure voice and video call. The Dialer Free is available to verified healthcare professionals, this allows physician adoption to drive paid subscriptions from Health Systems.

Dialer Pro is a paid version with some enhanced capabilities and Dialer Enterprise is available for purchase by health systems hospitals. More on this below.

Doximity for Pharma / Health Systems

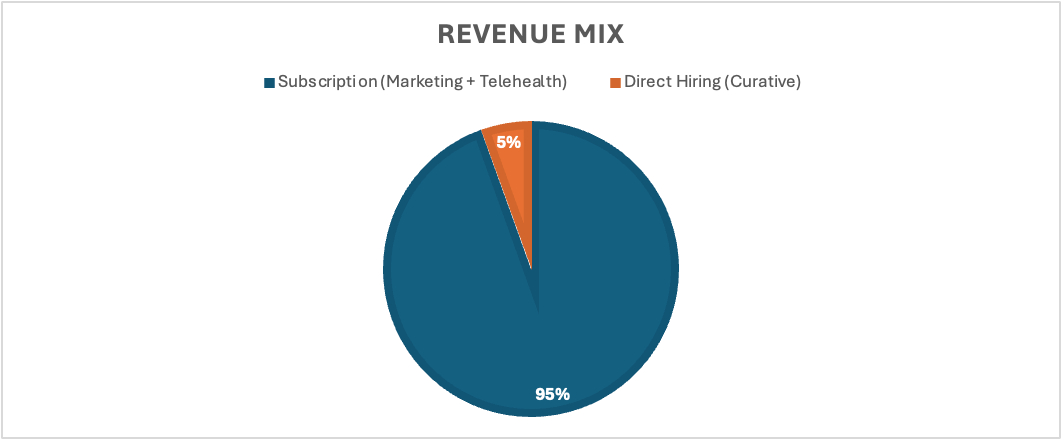

DOCS generates revenue from their Pharma and Health system customers who pay for access to the valuable network of Doctors. They are typically charged on a subscription basis per module or per bundle of modules.

The pricing model: Quality of Audience > Number of audience members > Type / Number of modules.

For example, with the quality of the audience; the top 50 Cardiologists would cost more than the next 50, and so on.

Pharma engages in an annual upfront buying cycle at year end where they purchase the bulk of their yearly marketing and make smaller mid-year add-ons. In a typical year DOCS will have ~60% of next year’s revenue under contract, then 35% comes from renewal and upsell and 5% from new customers.

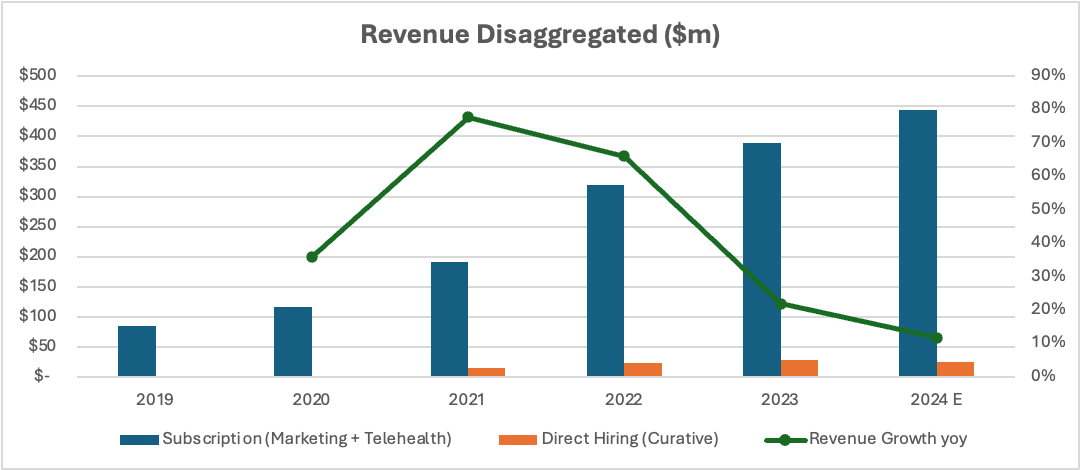

The company doesn’t break out its revenue further by customer type or solution but I have read that it is roughly;

- 70% Pharma

- 28% Health Systems

- Small contribution from Telehealth.

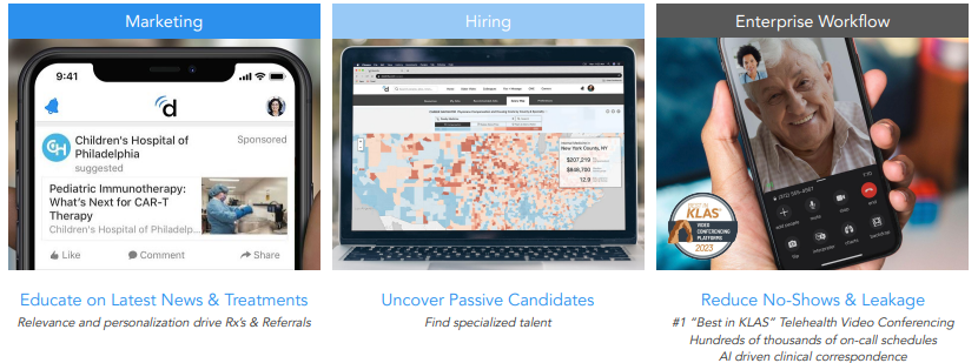

Marketing Solutions

These help their Pharma and Healthcare customers target the right users with their content / services through a variety of modules. Their customers are the;

· Top 20 Hospital Systems

· Top 20 Pharmaceutical Manufacturers

Pharma market their products on a brand-by-brand basis and Healthcare Systems market specific service lines, eg; Cardiology, Oncology, Neurology, etc. What surprised me here was the level of marketing done by hospitals in the US. This might seem alien to those in the UK or Europe but given that the healthcare system is largely private it makes complete sense that hospitals would market their specialties just like any other private business. Doximity sells the following modules;

· Awareness – Placing content in front of the intended audience to generate awareness.

· Interactivity - Enable digital activities such as conference attendance, connecting with a sales representative, booking an appointment, and ordering product samples.

· Peer - Enable members to connect and build professional relationships with thought leaders, department chairs, and other experts within the Doximity.

Hiring Solutions

These provide digital recruiting capabilities to Health Systems and medical recruiting firms, enabling them to identify, connect with, and hire.

They also offer an in-house hiring solution following the acquisition of THMED in 2020 which has since been rebranded to Curative.

· Job Posts – Individual listings on the platform

· Direct Messaging – Allows recruiters, physicians, and administrators to directly message candidates

Telehealth

· Dialer – Health Systems who purchase the product have the opportunity to brand the user experience and leverage their own security and HIPAA contractual requirements to create a consistent use protocol. This is sold as a subscription with pricing based on the size of the system.

· Shift Scheduling – This was added following their 2022 acquisition of AMiON, it provides shift scheduling for hospital systems.

The Market & Competiton

The Market

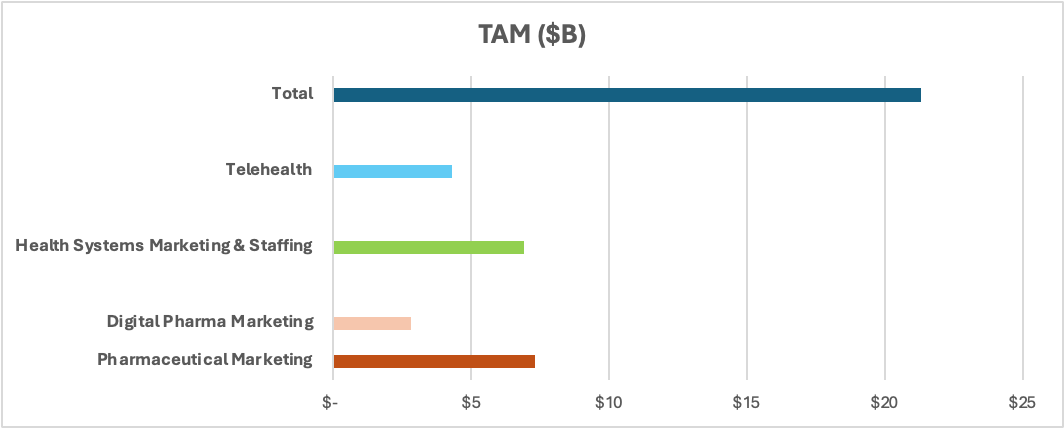

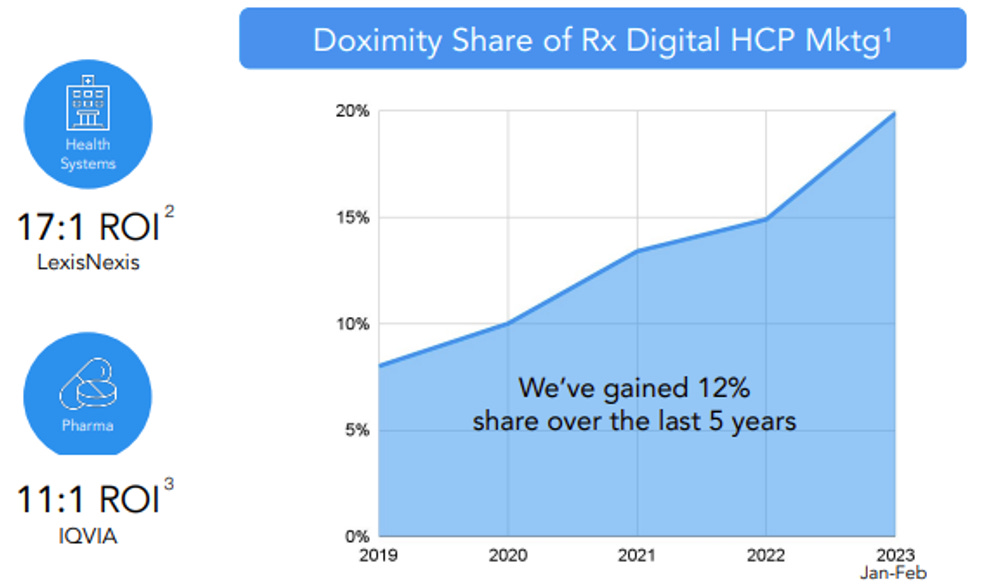

The TAM for Digital Marketing in their core Pharma market is ~$2.8b.

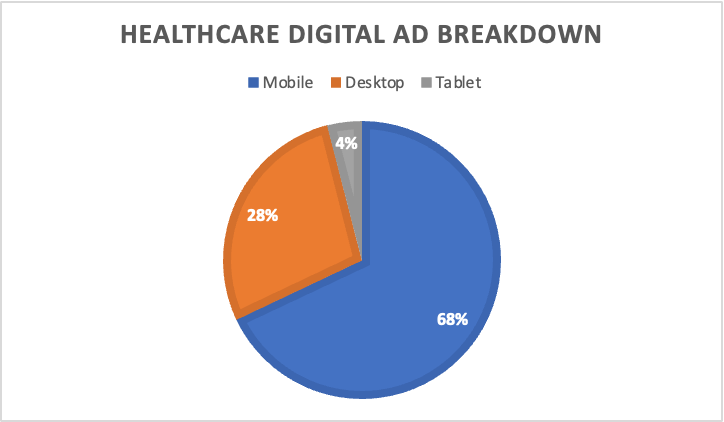

Within the healthcare industry, Mobile advertising represents the primary channel within Digital.

Digital increased its share of pharma’s marketing budgets markedly during COVID. I have varying estimates for Digital’s share of total marketing spend in healthcare, most sit around ~35% for 2021, up from ~24% in 2020. The concern for me is that COVID drove a significant pull forward. I was unable to find Data for 2022 and 2023 which would be very helpful in assessing the sticking power. In a tougher macro environment, it may seem prudent for pharma to focus on higher ROI digital channels.

Digital penetration still lags behind the broader advertising market which is ~65% but Pharma has a long legacy of using medical reps and may never reach those lofty heights.

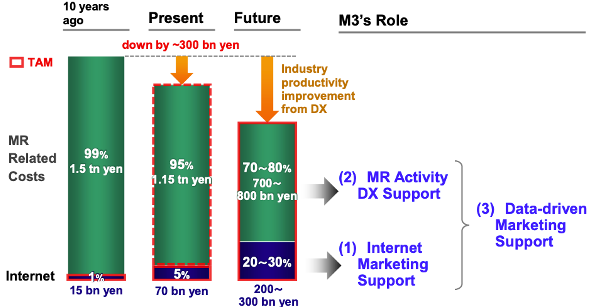

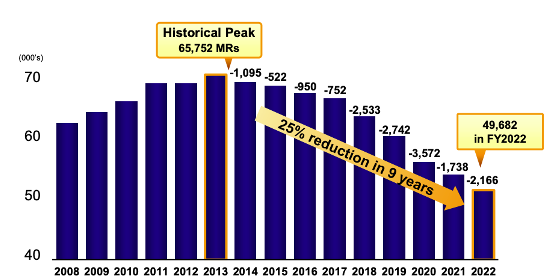

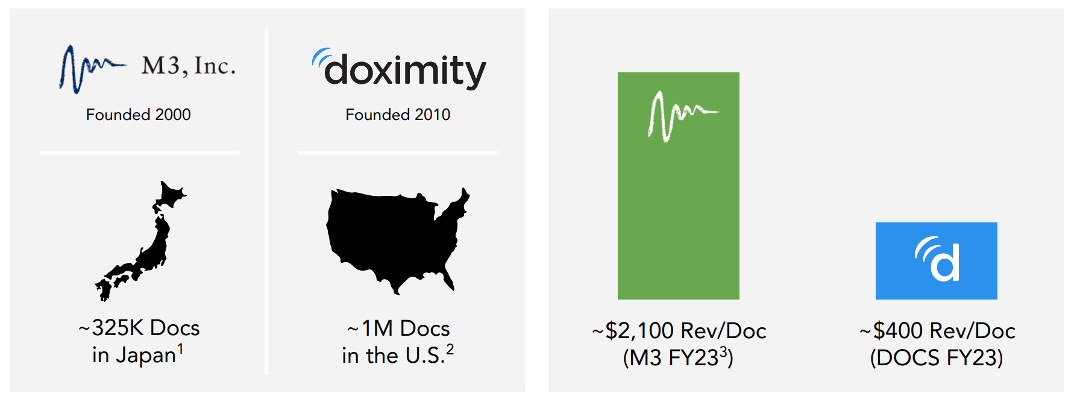

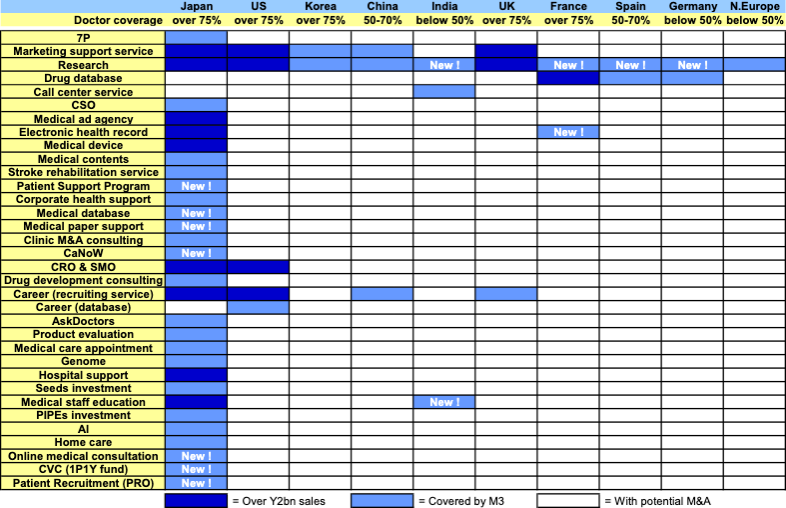

We can look to Japan for guidance where a company called M3 Inc operates a similar business model to Doximity but with a 10-year head start. Their site covers 90% of Japanese doctors. I will caveat these platforms are not exactly the same but we can extract some insights from the Japanese market.

· The advent of digital marketing in Japan has increased marketing efficiency for Pharma and actually reduced the total amount of dollars aggregated towards marketing. The impact has been twofold; 1) Higher ROI on digital ad spend allows pharma to achieve the same impact with fewer dollars, and 2) Professional networks/ virtual events increase the productivity of reps and keep costs down.

Thinking about market growth, if DOCS can make medical reps more productive this might free up incremental dollars for more digital spend.

· Mix shift. If I am reading the chart below correctly, Medical Rep expense is still the vast majority of Pharma’s marketing expenses and Digital penetration is far below the US at 5%.

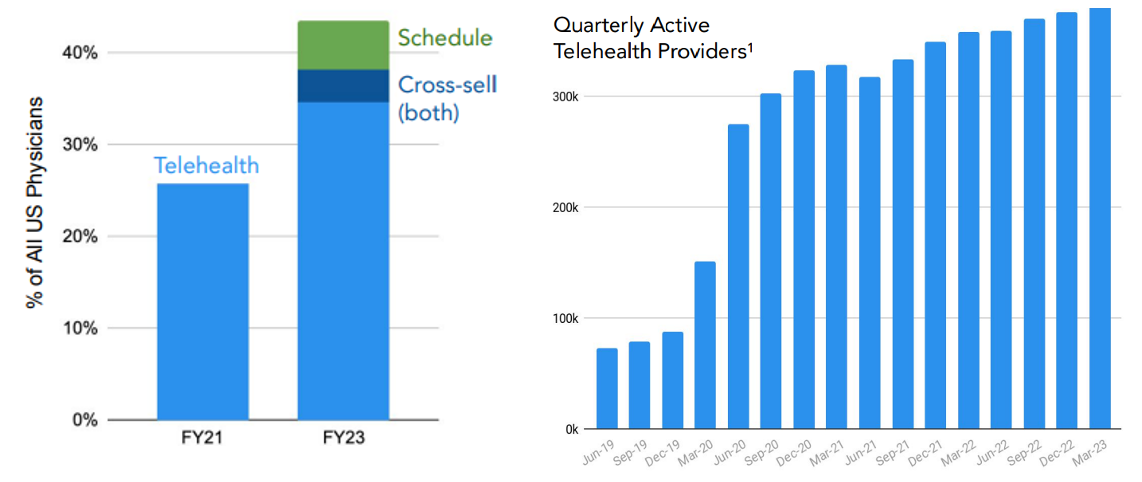

Telehealth Market

As of June 2023, their Enterprise Dialer and AMiON scheduling platform covers over 40% of the physicians in the US. DOCS has over 300k telehealth customers with a renewal rate of 96%. This surprised me given how competitive this emerging market is, but telehealth is incredibly sticky once you are in the door. Switching costs are very high, as hospitals go through months-long approval processes to get new products on their system.

As far as I know, Telehealth has not been aggressively monetized by Doximity and is given away for free or at cost in many cases to drive more engagement on the platform. This could be another leg to this story once the land grab in Telehealth is over, it is unclear what management’s intentions are for this business over the long run.

Competition & Moat

Doximity is not reinventing the wheel here. They are executing a tried and tested playbook in a niche vertical that is currently underrepresented on the mainstream platform of LinkedIn.

Importantly, with 80% of registered physicians already on the platform, they have hit critical mass here establishing powerful network effects. Doctors are time-starved. They have already built their networks on Doximity and had their certifications verified. A competing platform would need to present a far superior product to convert users and even then, migration would likely be slow. It took DOCS 15 years to establish its network with its ‘Physician First’ ethos. I have taken the following excerpt from the Risk Factors in the 10K, it is an indication of their commitment to servicing physicians. When it comes to corporate communications, don’t be fooled by corporate lip service, actions speak louder than words. Investors should look for tangible proof, the reference to action in the highlighted section below is a good indication of their sincerity. This message also comes across in many of their public communications.

Our “physicians first” philosophy may mean we make decisions based on the best interests of our members, which we believe is essential to our success in increasing our member growth rate and engagement, creating value for our members, and in serving the best interests of the Company and our stockholders. Therefore, in the past, we have forgone, and may in the future forgo, certain expansion or revenue opportunities that we do not believe are in the best interests of our members.

I believe that the network, and not the hungry wolves at the door (pharma), is what is worth protecting over the long run. Pharma / Medtech / Hospitals will always need access to this network, Doximity allows them to do that with ease and in one place. One thing that could weaken this network would be blatant exploitation and an over-commercialization of the platform. They may still retain their members, but engagement would certainly decrease.

These network effects will only deepen as the adoption of their productivity tools increases and more members join the platform (nurses/dentists, etc).

How valuable is a network?

It depends on how much those who want access are willing to pay for it. Right now, Doximity stands as the gatekeeper between the key decision makers in healthcare and the $4T in annual US medical system spending. Of that $4.3T, 73% is decided by doctors. This might be one of the most valuable networks in the world.

Doximity also competes with their Recruitment customers following the incorporation of Curative. In my mind, Network effects are probably best fostered when there is no competition with your customers. Why would you erect any barriers to adoption? The clear caveat to this would be Amazon, who have long competed against sellers and still managed to succeed alongside.

When evaluating the strategic rationale, we need to weigh the size of the recruitment market they are potentially jeopardizing versus, the revenue opportunity available to their Curative solution.

So, there are 23k doctor vacancies in the US annually, and 27% of physicians utilize placement services at an average fee of $25,500. This places the total TAM at ~$160m.

DOCS generated $29m in revenue from Curative which would give them ~18% market share, providing this was all doctors. This was just 7% of sales in 2023.

A reasonable limit on share could be ~35% or roughly double where we are today say~$58m. So this is unlikely to be a massive part of the business.

Importantly, if the physician recruitment industry is generating just $160m a year, they are unlikely to spend more than 18-35% of this revenue on marketing.

So the rational choice might be to go directly for that market. Given the value of professional networks for recruiters, many will likely still opt to use the platform anyway and DOCS can capture this revenue and still participate directly in the market.

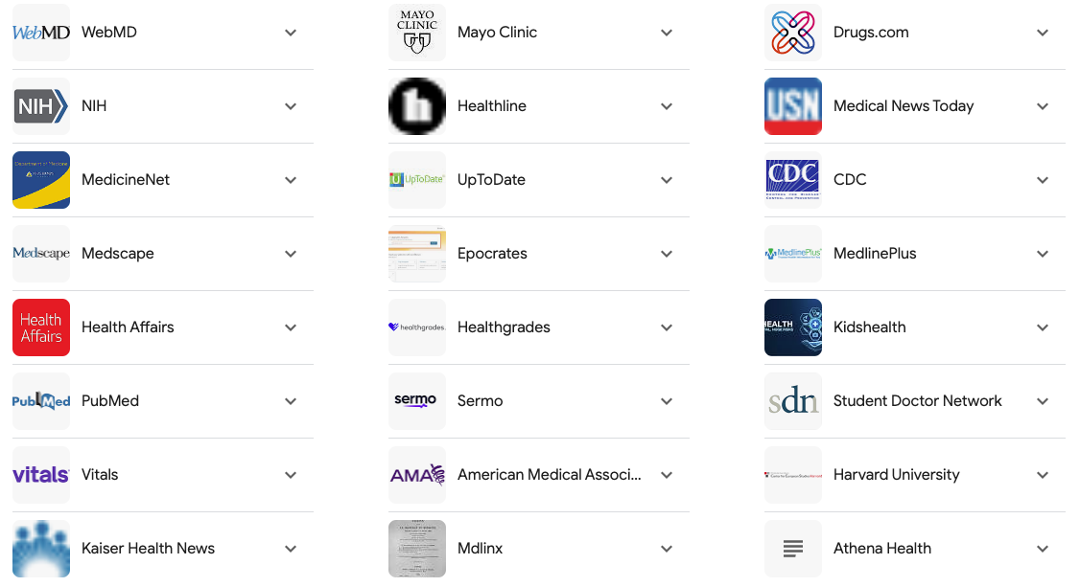

DOCS compete in many arenas;

· For Members; LinkedIn, Facebook, Google, Twitter, and smaller emerging companies.

· For Customers;

- Marketing – Online and offline outlets such as medical journals, research & news sites

- Hiring – Compete with industry job boards

- Telehealth - Zoom/ Teams/ Teladoc / Amwell

Competition for members is slim. The primary competitor is LinkedIn, and they lack verification which radically changes the usability of the platform for things like referrals. As I mentioned above, I think DOCS has achieved critical mass on network effects, and with 90% of medical graduates using the platform, this is only going to deepen.

The key question is how well they are servicing their revenue-generating customers vs traditional channels.

The long-term driver of this stock will be superior ROI above alternative digital and traditional marketing options available to their Pharma customers.

Hospitals and Pharma spend money on Medical Reps, Print Media, TV, Banners, and Medical Journal placements. Pharma expects an average ROI on medical reps of 2-3x and DOCS management quotes the industry ROI at ~3x.

Doctors use an array of online medical journals and educational platforms daily to check studies etc that make viable competition for digital ad dollars.

I don’t have ROI data for the other digital media platforms but DOCS are head and shoulders above the quoted industry average. I attribute much of the last year’s share gains to this superior ROI.

On their 2Q23 earnings call management said Pharma strives for a 3:1 return on spend, and we “Could raise prices at 20% per annum for 7 years before ROI falls to 3:1”

Management noted on their latest call that to date, 90% of R&D has been allocated towards enhancing the member experience and we will see a shift towards enhancing the usability for the customer going forward.

Financials

Financial Overview

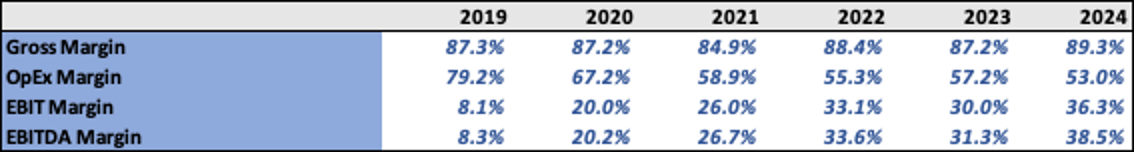

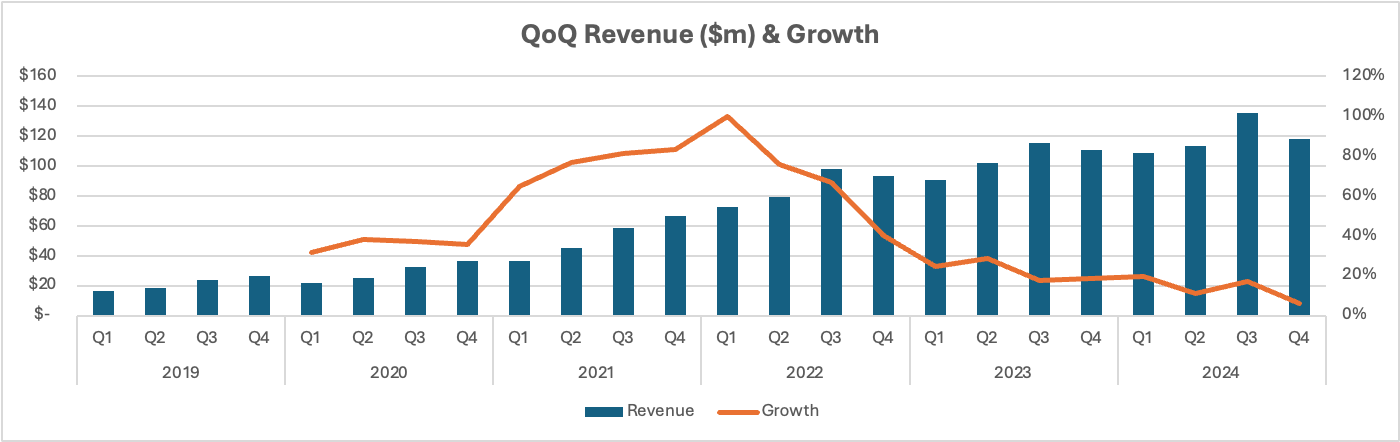

DOCS came public in June of 2021, so we have just a short insight into their operating history. What we can see in this short window is rapid growth as the company monetized its very valuable network.

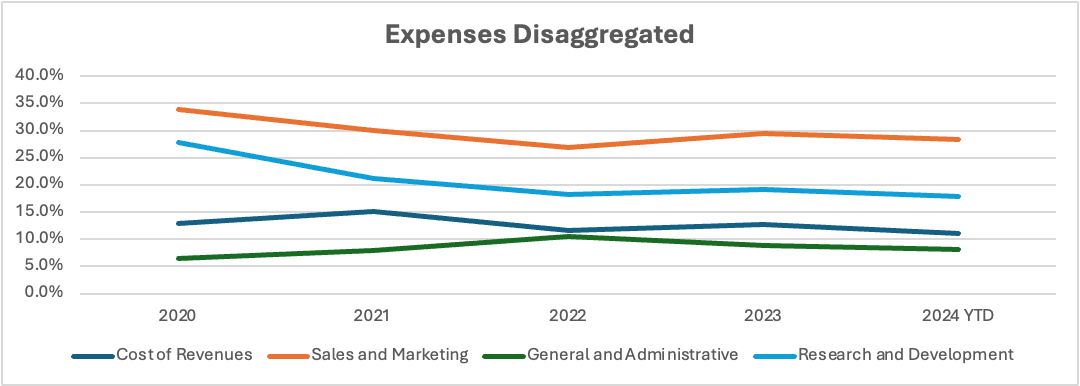

Importantly, this rapid growth has brought massive operating leverage with EBITDA margins now in the mid-30s. Management target long-term margins in the mid-40s.

The company is printing cash and ROI is in the high teens. The return profile should strengthen over the coming years as they continue to grow. With a margin profile like this, you would want the strongest of moats for defense and it doesn’t get much better than network effects.

KPIs

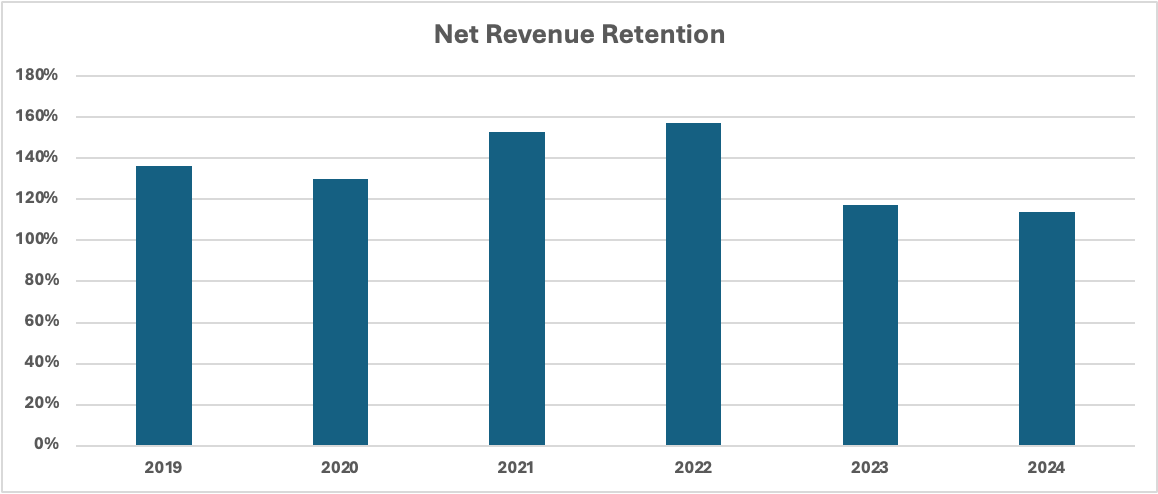

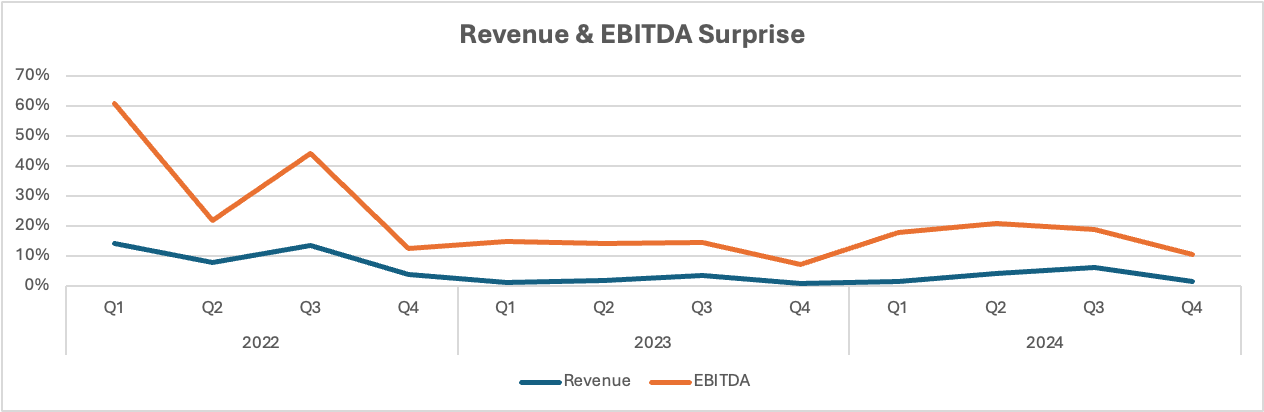

Net-Revenue-Retention has decreased in 2023 due to weaker upsell against a tougher backdrop for pharma marketing budgets.

It remains well north of 100% and was arguably unsustainably high during COVID. Management quotes LSD gross churn per year which will be partially driven by patent expiry. A declining NRR rate would normally be a red flag for many tech investors but we need to accept that marketing spend will always be inherently cyclical. DOCS has plenty of idiosyncratic growth levers and sits in a growing market but the pace of growth will be cyclical.

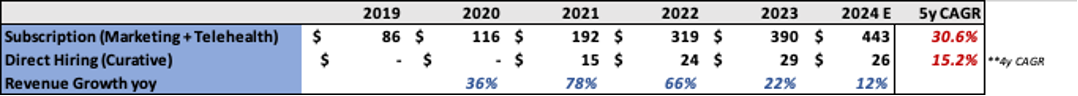

By Product

During the IPO the company raised $548m in net proceeds and have $762m of cash on the Balance Sheet.

DOCS issues SBC heavily, this is probably partially a function of their IPO. Management noted this would increase to 12-13% of sales in the future as they continue to invest in their staff. In my model forecast some leverage from 2027 onwards. Dilution is expected to be offset with share buybacks.

Recent Performance

Summary

I think it is worth scanning over the following commentary. The lack of visibility is inherent throughout as management navigates a return to normality following an overly excited COVID market.

To sum it up. The cyclicality of marketing spend becomes apparent and the secular shift to digital slows as the market digests the rapid shift made during COVID out of necessity.

2023

Q1

· Revenue grew 25% yoy, and NRR was 139% with growth even higher in their largest customers. They noted that upsell of mid-year add-ons, which historically counted for 10-12% of annual revenue growth, has slowed. There was no increase in the LSD gross churn they typically experience.

· Doximity Dialer has 350k unique users and clocks 200k patient calls per workday. The company’s Fax & E-Signature product does 30k per workday, double the pre-pandemic levels.

· The company lowered EBITDA guidance by 6% at the midpoint as customers are cutting costs on new digital products in a tougher macro environment. They did however reiterate they are comfortable with a 20% long-run topline run-rate.

· Adj EBITDA margin was 33%

Q2

· Revenue grew 29% and NRR was 128% with their largest clients still growing faster at 138%. Hospitals have been their biggest spenders this year and pharma industry sales are up just 12% following a digital marketing air pocket earlier in the year.

· They also highlighted growth in Pharmacist members and customers and progress in their MedTech and mid-tier pharma initiatives.

· Fax & E-Signature saw record use and Telehealth now has 370k unique users and 3k calls per day with zero churn in enterprise clients.

· Another new feature was announced, the ‘While you wait widget’, pushing doctors notifications in the 1-minute window before a telehealth call starts.

· Gross margin was 90% and EBITDA margin grew 400bps to 45%. They guided to 43% for the FY.

· Management reiterated their guidance for 25% topline growth at the midpoint.

Q3

· Revenue grew 18% and NRR was ***. Q3 is their largest sales quarter.

· Telehealth had 375k unique users and their Dialer product covers more than 35% of all US Physicians.

· Gross margin was 91% and Adj EBITDA margins were 48%

· DOCS announced that New Peer-Peer / Point of Care modules offering vertical videos hit content approval delays. The Medical Legal Review (MLR) is a key moat in the pharma industry and with this new form of content, they went back to MLR square one.

· Management now expects a 2% miss on the midpoint of annual guidance due to this. They reiterated this revenue was delayed and not lost as it is still under contract. FY revenue growth is now expected to be 22%.

Q4

· FY sales of $419 were up 22%, and Q4 sales were up 18%.

· Adj EBITDA margin was 46% in Q4 and 44% for the FY.

· They noted they had engaged in ROI guarantees on some of their contracts. I am unsure whether this is any indication of a tougher selling environment or a more competitive digital marketplace.

· The company bought AMiON, a daily scheduling tool for hospitals for $53m.

· Guided 2024 growth at 20% of which ~60% is currently under contract.

2024

Q1

· Revenue grew 20% with growth continuing to stem from their top 20 clients. NRR was 118% and 124% with top customers. Despite record upfront selling, their mid-year upsells have slowed for two years in a row. Management outlined two reasons, 1) Slower market growth as the shift to digital has slowed. 2) Friction of the full-service white glove service. Their model requires meetings and time which clients don’t always have. Share has been shifting to Banner ads and Programmatic advertising, where advertisers can manage their own campaigns. This is the first sign of a structural vs cyclical pressure.

· How did things change so quickly? June is when most contracts get signed, and their close rate dropped. Their pipeline had fewer face/face client meetings and they were losing share to new market entrants with banner platforms. They believe their ROI is still consistently higher but they have fallen behind on ease of purchase / execution, “4 clicks vs 4 meetings”.

· In response to changing market preferences DOCS announced the development of a new ‘Self Service’ platform. This could help capture share with smaller clients and reduce some cost internally with less need for sales reps. It will be interesting to see how this will impact pricing, I will expand on this in a separate section later.

· Telehealth now has 385k users and their portfolio of solutions (Dialer / Scheduling) covers 44% of all US physicians.

· Signs of cracks appeared with a 10% reduction in headcount, ~100 employees, incurring $8-$10m in related severance expenses.

· This all amounted to a 10% chop in guidance to 10% for the FY, or half of what the street had expected.

Q2

· Revenue grew 11% and NRR declined again to 114%.

· Daily user growth hit a new record, with Workflow/ Telehealth services reaching 550k unique subscribers and continuing to gain share. DOCS now counts 16/22 top hospital systems as customers.

· Two new products were launched; 1) Doc Defender – this protects a physcian’s family’s home address/ numbers by requesting takedowns from other people's finder websites. This is a free service for doctors that originated from a physician summit.

2) The Self-service pharma client portal – this was rolled out to a dozen test clients, and they will open this up early next year.

· Management guided towards 11% FY topline growth and adj EBITDA margins of 46%. No change from last quarter but they withdrew the long-term 20% growth target as expected continuing cyclical pressure on growth. They also noted they are not leaning too aggressively into price in this market.

Q3

· Revenue was up 17% and NRR was 115%. The upsell season this year was more condensed which positively impacted Q3 so it may be hard to extrapolate the acceleration in revenue growth.

· Their Point of Care modules grew 100%, gaining better traction. Bear in mind these were only introduced last year so this growth is off a very low base.

· The Self-Service portal was opened to 10% of clients. Importantly, management indicated that rollout would occur over several years following advice from investors. This shelters us somewhat from any radical changes and allows management to learn and adapt as they go based on performance.

· Guidance was raised for the first time in many quarters, they now expect 13% growth at the midpoint. This is above the expected market growth of 5-7%.

Q4

· Revenue growth decelerated again to $118m growing 6% yoy, 1% ahead of expectations. Growth in the top 20 clients was strong again at 22%. NRR was 114% on a consolidated basis and 122% for their top 20 clients. Their Health System customers are spending less on marketing as they focus on a return to profitability, health system growth was guided to be flat in 2025. Counter to this they continue to take share in Pharma with leading ROI. Importantly, they guided towards 10% growth in the pharma market in 2025, up from 5-7% last year, indicating their core market has digested those tough COVID comps.

· UAM were all up DD yoy with daily users growing the most. The median ROI is still above 11x for pharma.

· Adj EBITDA margin was 48% and FCF margin was 37%. For the FY adj EBITDA margin was 48%, up 400bps.

· Over 2024 DOCS bought back 5.5% of shares outstanding and announced the authorization of an open-ended $500m buyback plan. They continue to see this as a strong use of FCF.

· Investors got more info on the Self-service Portal. This was rolled out to an additional 10% of the customers and management announced the three-phased approach; 1) Reporting, 2) Purchasing & Pricing, and 3) Content Creation. They assume no upsell impact in 2025 guidance leaving room for surprise.

· Guided towards 11% topline growth for 2025 and adj EBITDA margins of 46%. · The stock was up over 20% on the quarter, the street cited a beat on margins.

Where do we go from here?

Growth Opportunities

What kind of runway for growth has Doximity got? They have already acquired most of the members in their core market, but this does not mean the monetization journey doesn’t have room to run.

Market Growth

DOCS guided towards market growth of 10% in 2025 with the scope to reach LDD again. Whilst this is likely to slow there should be a continued shift to digital as marketing dollars follow higher ROI channels.

Growing the Doximity Network

DOCS already count the vast majority of registered physicians and an even higher share of graduates as members but there is still room to run with other professionals. They have only 60% of nurse practitioners and physicians’ assistants.

There is also significant whitespace in; Dental, Physical Therapists, Psychologists, and Pharmacologists. What I find most interesting about this group set is that many will operate independent practices or sit within a smaller network. This means a greater proportion of these populations are likely to be responsible for purchasing decisions, a valuable contact for anyone selling product / services.

They should also benefit from an increased shift to digital advertising as the younger generation becomes a larger share of the overall health network.

New Customers

There should be room to grow their customer base by engaging more pharma companies and health systems. Their new Self Service tool will allow them to capture and share with smaller clients who previously couldn't justify the minimum commitments needed for a white glove service.

There has also been talk about initial engagement with Medical Devices and Diagnostics companies where they have expanded their sales team This would open another massive list of customers, whilst leveraging the same network. I would be keen to understand the nuance between how Pharma and MedTech companies sell and whether the platform would be equally useful for both parties. Judging by the fact that this is still nascent I imagine the value proposition is not the same. MedTech is more demo-heavy, which relies on in-person visits and reps. Your pharma rep does not demo a drug but an interesting vertical all the same.

Increase penetration with existing customers

Penetration is still very low within their existing base, and customers have a track record of increasing spend. Doximity operates a ‘land and expand’ model, with a customer typically trialing the service with one brand / service before adding more brands and utilizing more modules to market them. The company has tripled its revenue from its top 20 customers since 2019.

DOCS gets most of its revenue from Mega Brands (drugs with over $100m in sales) and quotes tirelessly that the majority of its revenue growth comes from existing customers. There are ~430 Mega Brands in the market and they work with ~245. Let’s make sense of this busy chart above.

· Doximity already works with ~245 mega brands but has whitespace of 185 brands to capture share.

· I remade the chart above in Excel using the middle of each range and drew the following conclusions;

- DOCS has 5.7% share of the total market by that crude math. The chart quotes 4%, we will take their estimate.

- DOCS has 10% share of their existing client base.

I will put it this way. If they can increase penetration with all the sub-5% brands and bring them to the midpoint of the next tier at 12.5% then this would generate 48% growth without any new clients or further upselling of bigger clients.

All in, I see a long runway for growth in their core pharma marketing business. The existence of brands spending north of 20% of their budgets with DOCS is very encouraging.

Monetization of telehealth

Telehealth is a very busy space and not an area DOCS heavily monetizes. It appears their Dialer product has already garnered meaningful share as they were able to grab share quickly in a new and emerging market during COVID.

Their AMiON product, on the other hand, will have to fight an uphill battle to replace legacy solutions. Hospitals only recently got telehealth, but they have always had some form of scheduling tool which I can imagine is very sticky.

Their advantage here is that they are already in the hands of the nation’s doctors and their platform is free to use creating little barriers to adoption. This may remain under monetized for the next decade so I won’t include it in my model but it provides some option value down the line.

Strategic M&A

DOCS generates a lot of cash, and this begs the question, what will they do with it? Strategic M&A seems like the natural choice for a relatively young and growing company with no debt. Their current cash balance is $762m with a market cap of $5.23B.

New technologies / services could help increases the stickiness of the platform and create small cross-sell synergies. This risk is always that they continue to grow outside of their moat and move into more competitive markets without any clear natural advantage.

M3 Case Study

Doximity is a one-of-a-kind asset in the US but we can look to Japan for some guidance. Management quoted Rev/ Doctor numbers at their Analyst Day for M3.

It is hard to parse out how fair a comparison this is. All of M3’s annual filings are in Japanese, and they have just one pitch deck in English.

Ultimately, this is a different business. M3 generates revenue from areas outside of marketing where at present, whereas DOCS only leverages additional platform functionality to deepen their network effects and platform engagement to strengthen the core advertising business.

Rev/ Doctor of $2,100 is likely a very high number but it still indicates a very healthy runway. One encouraging point of note from the above chart would be that their MedTech business is one of their largest.

Tieing it all together

Management had previously guided to $1b in revenue by 2028, forecasting a 20% topline CAGR. Driven by;

The continued shift to digital marketing

Expansion into new opportunities

Growth in their top customers.

This target has since been rescinded due to cyclical pressure. This forecast anticipated 14% growth in the core business which is what I will focus on in my modeling.

The growth algorithm is a black box. I can see many levers for growth and a solid runway in the core business, but it is hard to put numbers around it with any great precision.

The company’s superior ROI has allowed them to push L/MSD price per year and management quotes they could raise prices by 20% per annum for 7 years before this falls to the industry standard. They also noted that they would not be taking price aggressively in this market which lets us know there is elasticity there.

I am confident in LSD pricing as a floor in my model over the long run

A long runway for increased penetration with existing customers led by superior ROI

New members and New Customers

Margin Opportunity

Doximity already boasts some pretty healthy margins, but there is no reason they can’t go higher. Corporate expenses have levered effectively under strong revenue growth and management has a long-term target for adj EBITDA margins of 45%. Given the scarcity of their asset, strong network effects, and exceptionally high gross margins this should not be outside the realm of possibility.

A quick look at costs;

· COGS – Contains cloud hosting costs, personnel-related expenses for customer success teams, third-party platform access, and contractors. This is tied to member growth and utilization the company has guided to flat margins over time.

· R&D – Personnel expenses relating to engineering and product teams along with third-party services and contractors and software related tools. There should continue to be some leverage on the R&D line as they scale. The company has 1/3 of its employees working in R&D.

· S&M – Salesforce salaries including incentive comp, travel, and event expenses.

· G&A – Backoffice personnel expenses and expenses for third-party accounting / legal services. I expect to see operating leverage on this line.

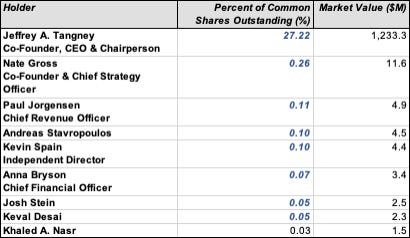

Management & Culture

Who doesn’t like founder-led companies?

Apparently, Jeff is a good operator but not much of a Wall Street guy. Accessibility is limited and he has delegated much of the communication to the CFO and IR. After 5 quarters of reducing guidance, they have very little credibility with the street right now and I got the impression that many investors we waiting on the sidelines for a few quarters of consistent performance. This could be the opportunity here for those with patience.

Insider ownership is very strong but remains highly concentrated with the CEO. Interesting that the other Co-Founder and CSO owns so much less but has been around for an equally long period.

NEO comp is almost entirely salary and non-equity incentives. This is intriguing, we know they have a massive SBC expense which must be allocated towards regular employees. I don’t know how I feel about this, on the one hand, alignment of senior management with shareholders is very important. On the other, NEOs were given stock in the IPO and still own a substantial amount of stock on an absolute basis.

A small note on culture from Doximity;

“At Doximity, we organize our teams into small, nimble groups that operate autonomously, are empowered to make decisions quickly, and aim to stay close to our members and customers”

Whilst we have to take this at face value, it reads well, indicating an understanding of the power decentralization and development of an entrepreneurial culture. Much of what I have gleaned about corporate culture has come from reading on Constellation Software which certainly sets a high bar.

Other Points

Self-Service Transition

This marks a structural change for Doximity with a relatively unknown impact. Let’s unpack this;

Self-service will allow DOCS to capture more of the market with small/medium brands by removing the high minimums associated with the prior white-glove service. DOCS currently have a $250k minimum due to the high onboarding / customer support costs in the white glove model. On the latest call, they announced this change would allow them to profitably serve customers with a $100k minimum.

The transition may alleviate the need for certain sales reps over time and result in a long-term benefit to margins.

What it will give clients is greater visibility and customization in their marketing. With leading ROI this may give customers the confidence to spend more on the platform. More data = More conviction. Previously customers got a report once a year, this could benefit the mid-year upselling cycle.

Price discovery could be impacted positively or negatively. Perhaps pricing will become more cyclical? Very high in a good market but also falling weaker times. This is one of the biggest unknowns for me.

Any changes this may cause to the buying cycle could negatively impact visibility longer term. Pharma operates on upfront buying, locking in 60-70% of their spending in December, usually at a discount. If there is no bifurcation in price there may be no incentive to lock in spend. This won’t change overnight but a further reduction in visibility for DOCS would not be a positive development.

Big business model changes that are not well understood would normally be a reason for me to step back. However, management has indicated their intentions to go slow and roll this out over many quarters which will allow them to learn and adapt along the way.

Pricing & ROI

On the newsfeed, 1/12 of cards are currently sponsored content and management has indicated that this could reach 1/4 or 1/5 without impacting the user experience. I do question, however, how this would impact ROI. Engagement would surely need to increase in order to achieve the same ROI? DOCS continues to release new tools to increase time spent on the platform thereby increasing supply.

It is all about untargeted doctors. ROI will only decrease if the same doctor is being targeted again and again…. so the important figure is what percentage of the network isn’t being monetized at all. It is impossible to know but I will be watching changes in ROI keenly going forward and will endeavor to gain greater clarity around ROI as I learn more.

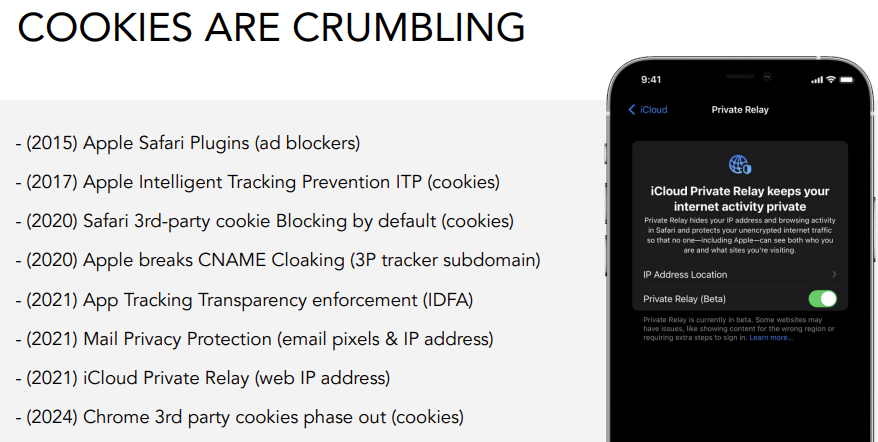

Insulation from IDFA shakeup

Privacy has become an increasingly hot topic as the internet has matured, and the US is arguably behind Europe in this regard. The last few years have seen big moves by private companies to protect users’ data which has disrupted the online ad market.

DOCS don’t rely on other networks for information on their users. They are uniquely insulated in this regard as they can provide targeted ads using only the data physicians willingly enter into the platform.

Risks

I have addressed the larger debates above. The risks outlined below are not show-stoppers but things to be mindful of.

· Customer concentration is high and increasing. This matters for two reasons, 1) Credit / Revenue risk, if this customer were to go bust or reallocate dollars elsewhere following an issue with the platform then the impact would be substantial. 2) Price Pressure. This for me is the more worrying side to higher customer concentration, the ability to push back on price. Big pharma will also leverage ad agencies (McCann Health / Publics Health / WPP Health Practice) that already use their scale to achieve discounts.

· Dual Class Share Structure. Pre-IPO shareholders, including the founders, control 98.5% of the voting power through ownership of Class-B shares which have 10-1 voting power, whilst public shareholders own Class-A.

The Model

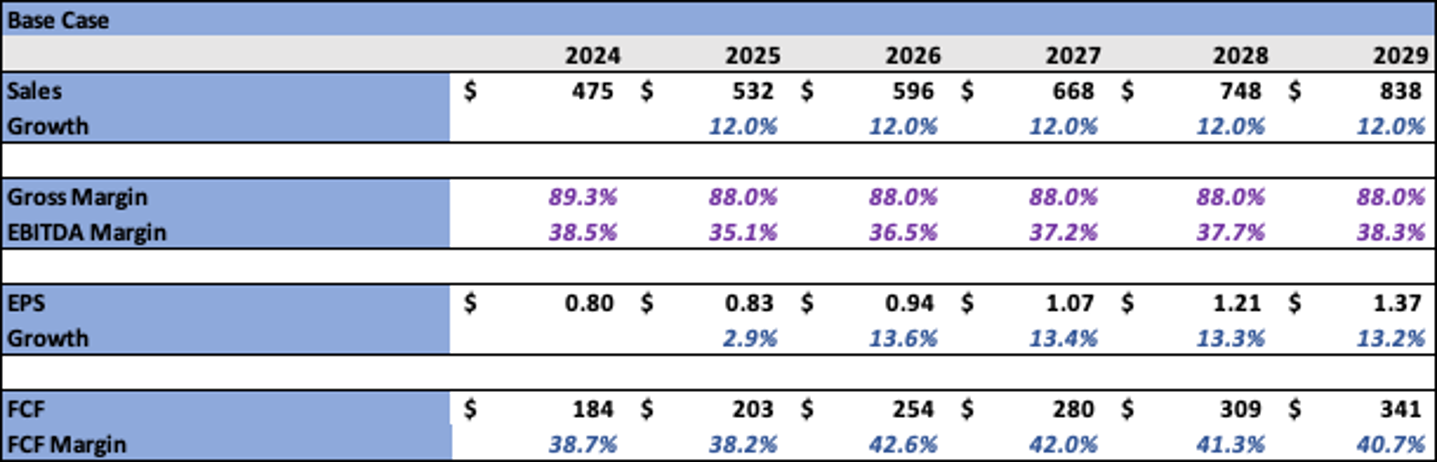

Base Case

Sales - I assume L/MSD pricing growth + MSD market growth + ROI-driven share gains leads us to a 12% CAGR.

Gross Margin - This has been relatively stable historically so I have held this at 88% in all scenarios for simplicity.

Operating Costs - In my Base Case I don’t assume any operating leverage on S&M or R&D, these grow in line with sales. I forecast G&A leverage and have this line item growing at 4% per annum in all scenarios. G&A is only 8% of sales so this is not over consequential.

Other Income - DOCS have a healthy cash balance of $710m on which they earned ~2.7% in interest income in 2024. I have this dropping to 1.5% in 2025 and 1% the following year. This accounts for lower future interest rates and/or a reduced cash balance.

Capital Allocation - I do not model any M&A or share repurchases. These have the potential to drive up our EPS CAGRs by a few percentage points in each scenario.

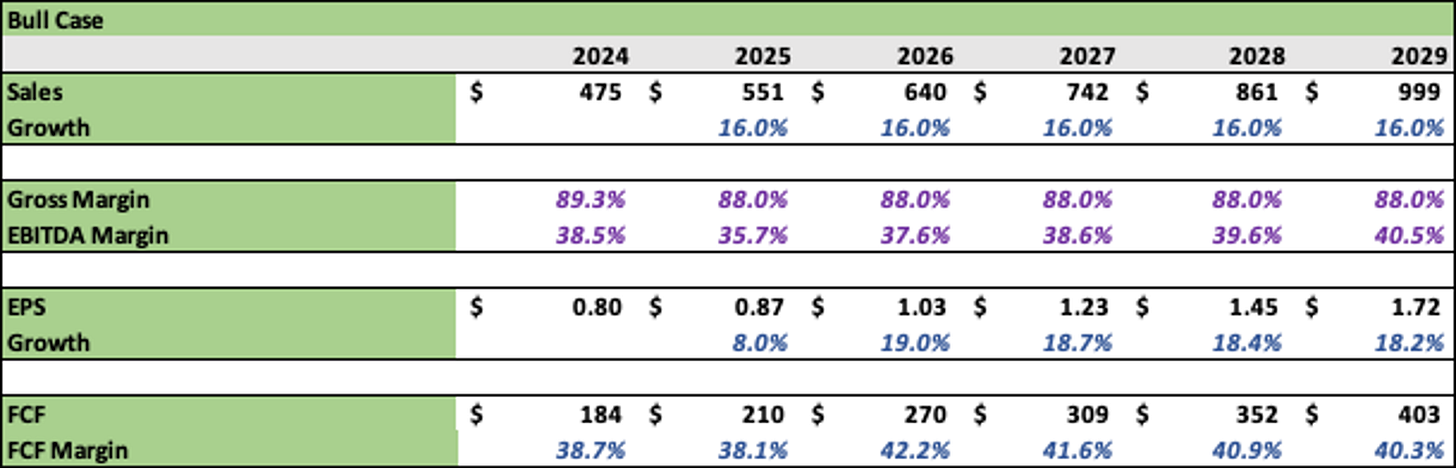

Bull Case

Sales - All of the key growth levers mentioned above are stronger and drive a 16% topline CAGR on the basis of superior ROI.

Operating Costs - DOCS achieves operating leverage on S&M and R&D with both growing at 0.95x sales. This is lower than historical levels of 0.86x and 0.65x respectively, but are the growth forecasts. The company is approaching a more mature margin structure so leverage gains should be steady and modest.

Bear Case

Sales - Assuming weaker market growth and slower share gains results in 6% growth. The MSD growth rate is held up by resilient pricing and some penetration gains with existing customers. As long as ROI remains elevated above other channels there should be room to run in pricing.

Operating Costs - I forecast negative operating leverage reflecting increased competition and the heightened need to market / innovate. S&M and R&D grow at 1.05x sales.

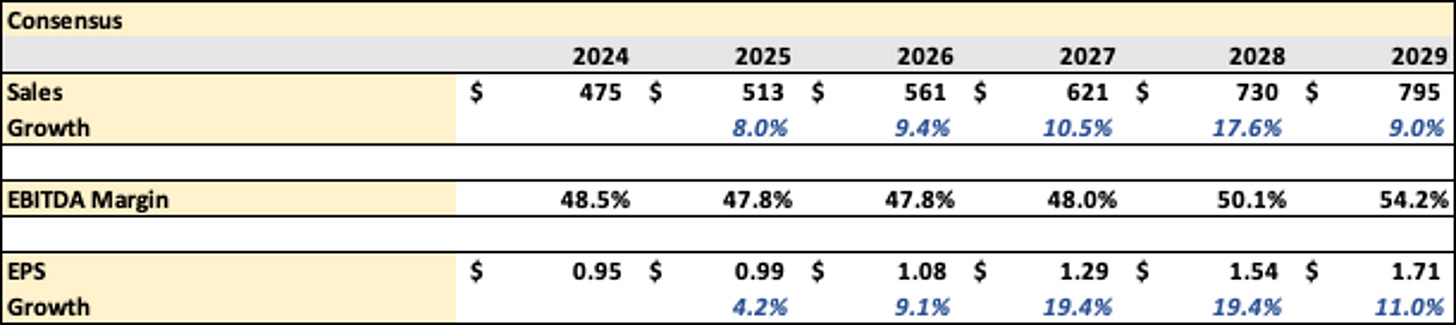

The Street

Sales are relatively in line with my Base Case.

The street adds back SBC to get to an adj EBITDA margin.

Valuation

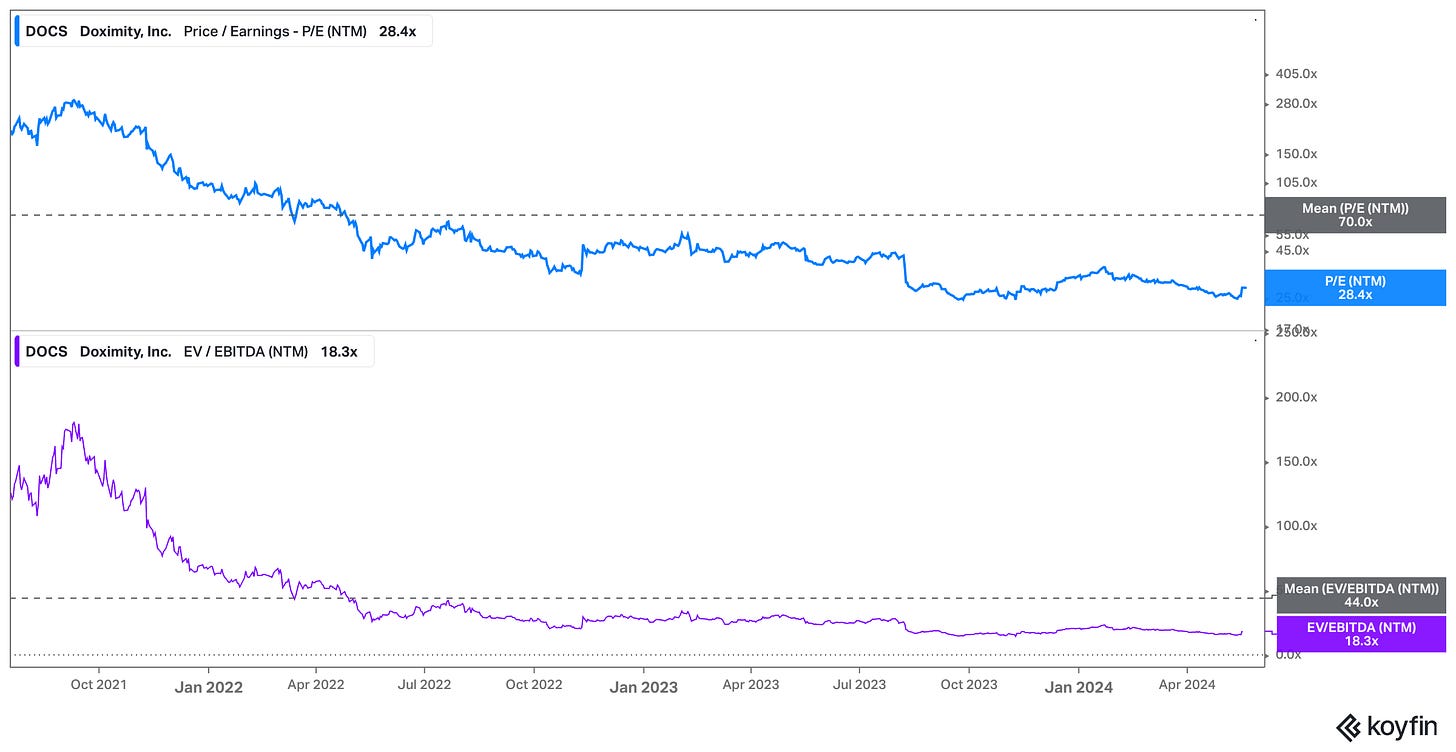

I first stumbled across DOCS shortly after they came public but at a lofty multiple of over 100x EBITDA, it was quickly sidelined. Nearly three years later the stock is down 72% from its peak whilst fundamentals have continued to march on at a healthy clip. Since the IPO, EBITDA has compounded at 47% CAGR which has resulted in an attractive valuation position.

By my modeling DOCS looks attractive at an EV/EBITDA of 23.9x on 2025 numbers in my base case for LDD EBITDA growth. Given the high FCF conversion, EV/FCF is also very attractive at 22x on 2025 numbers. I use an EV/FCF to account for the massive net cash balance effectively.

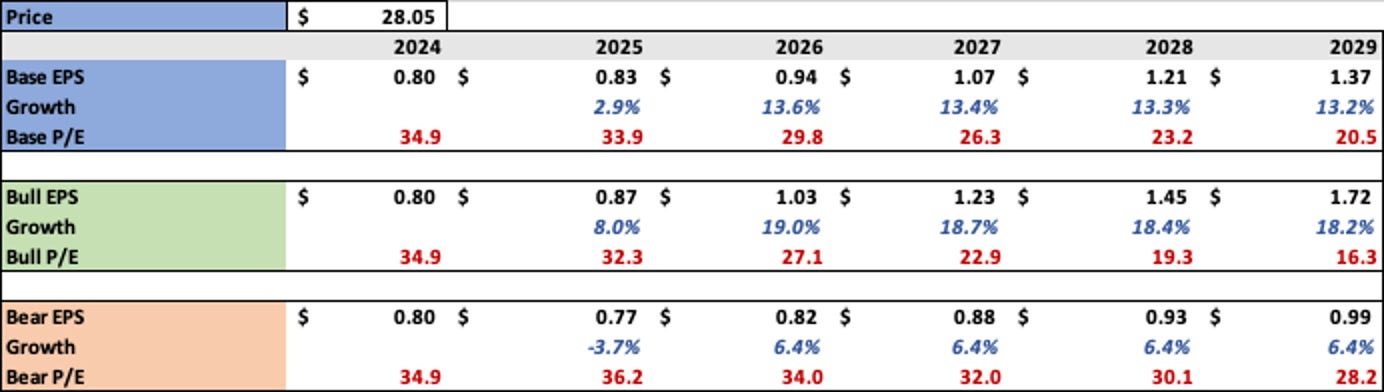

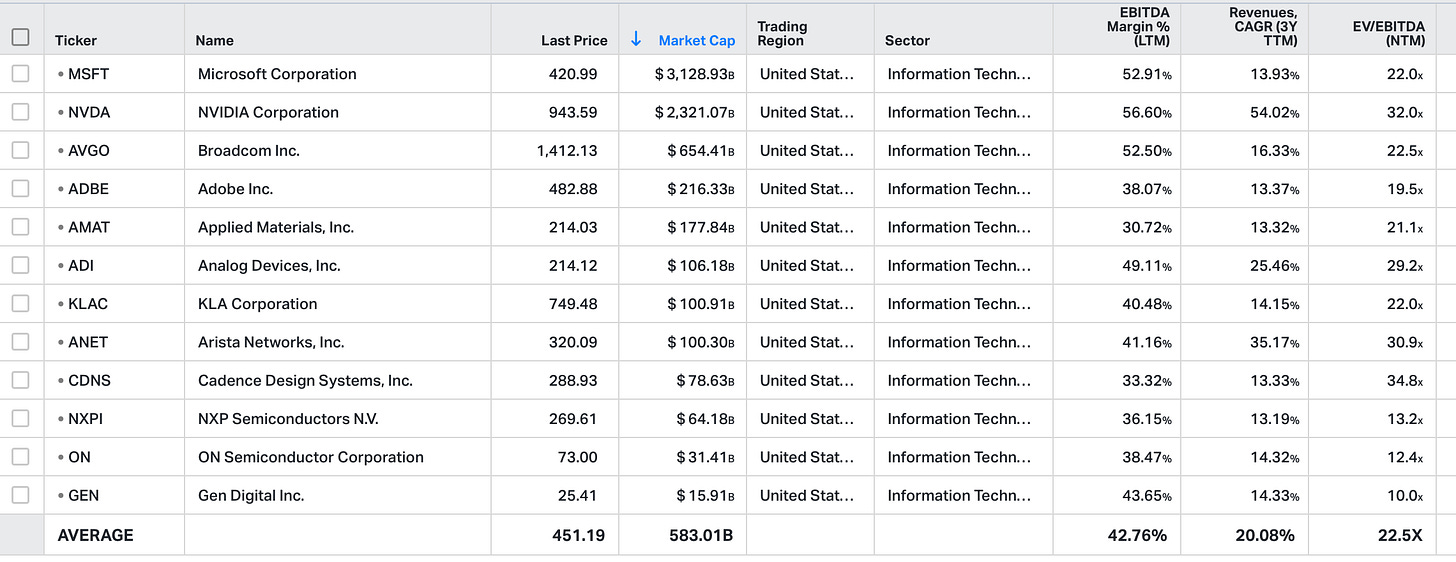

P/E

EV/EBITDA

EV/FCF

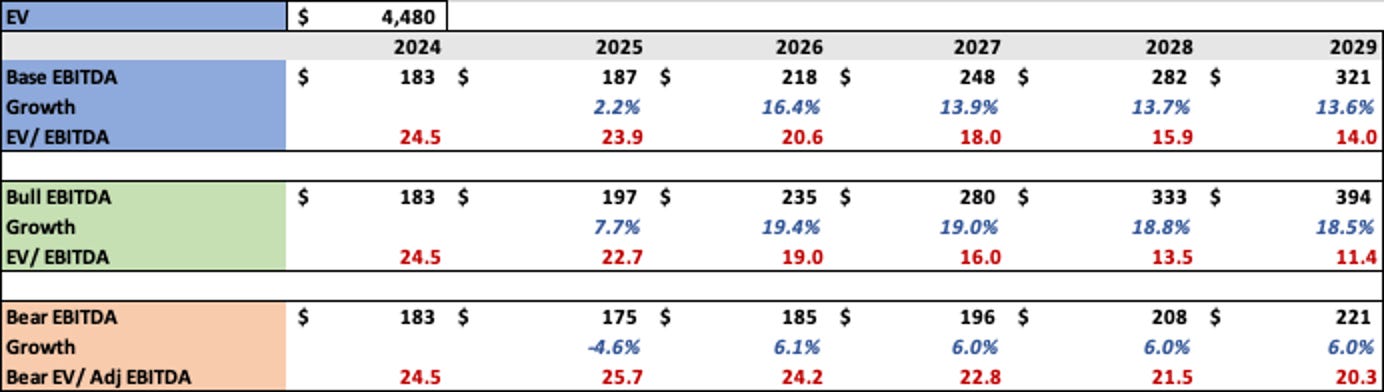

Running some multiple scenarios over my Base Case assumptions you can see the range of outcomes for the stock. DOCS was trading at 20x EBITDA pre-Q4 earnings which saw a 20% price jump.

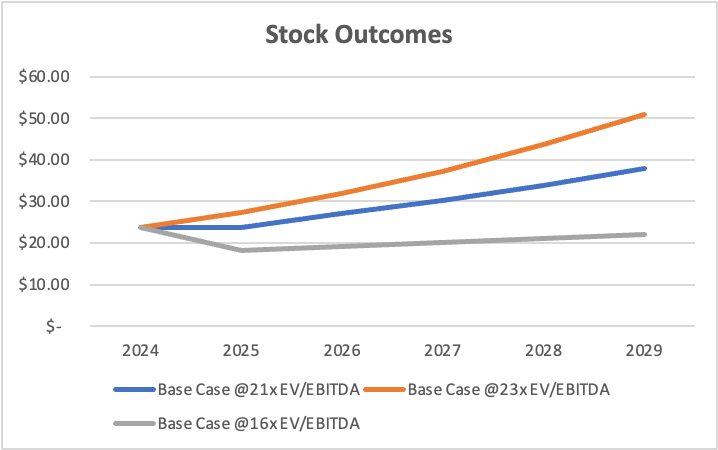

Finding a comp for DOCS is difficult. I use a basket of software names growing toplines north of 12% on a 3-year CAGR and EBITDA margins above 30% as a rough proxy. This group trades at 22.5x EBITDA, at a slight discount to DOCS following their Q4 earnings jump. Doximity has above-average adj EBITDA margins at ~47% and a trailing 3y Revenue CAGR of 31%. These are big blue-chip companies that dominate their markets, but DOCS holds a scarce asset that would be very difficult to replicate given the power network effects at play.

I don’t anticipate the multiple to climb much higher than the mid-20s without a massive acceleration in sales growth to the 20%+ range.

Importantly, the company has a long runway for growth and should compound for the next decade. This is a business with a tangible economic moat and compelling value proposition for its customers with industry-leading ROI. Bottom line, this is a business you should be familiar with at a fair price.